If you are a Director/Shareholder of a company there are some important tax changes taking place this 5 April that you should be aware of.

- The rate of corporation tax will increase to 25% for company taxable profits above £250k and for profits between £50,000 and £250,000 the effective rate of corporation tax will be 26.5%

- New “associated company rules” may impact on the rate and due date of corporation tax due if there are other companies controlled by the same or same group of shareholders

- For individuals, the dividend nil rate allowance is dropping to £1,000 from 6 April 2023 and to £500 from 6 April 2024

- The level of taxable income above which individual taxpayers start paying tax at 45% is dropping from £150,000 to £125,140.

This will lead many shareholders to consider whether their company’s current remuneration policy relating to dividend/salary split is optimal.

Tax is not always the most important consideration, but at present, in the vast majority of scenarios a modest salary and dividend remains more tax efficient that only salary when looking at extracting profit from a company.

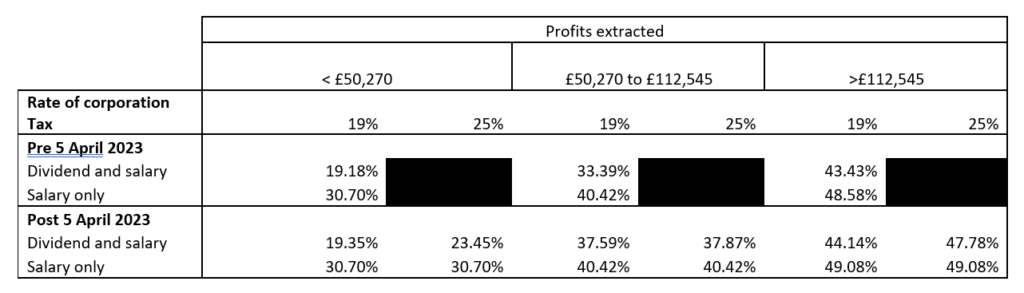

Taking all taxes into account, corporation tax, income tax and national insurance, the effective tax rates at different personal income levels pre and post 5 April 2023 are:

The key points to note here are that whilst in most cases the effective tax rate is as you would expect increasing from 2022/23 to 2023/24, in all cases dividends still suffer a lower rate of tax than salary, however:

At the highest rates of income and corporation tax the differential between salary and dividend is now only 1.3% .

There is one scenario where salary may be favourable.

Where corporation tax profits of any company exceeds £1.5 million divided by the number of companies under common control, these companies may have to pay their corporation tax in quarterly instalments, ½ in year and ½ post year end. Paying a salary reduces taxable profit whereas dividends do not, and it may be worth the slightly higher effective tax rate to avoid going into the quarterly instalment regime.

We recognise that sometimes tax is not the only consideration when considering dividends vs salary – so despite the above rules of thumb, we recommend that you should always seek advice.

Please get in touch if you’d like to learn more.