Blog

Keep up to date with our latest Industry Insights

With so many changes happening in our day-to-day lives, it’s comforting to know you can turn to a valuable resource to keep you updated on all the things which may affect your business.

How do I pay less Tax?

This could be one of the most frequently asked questions that accountants receive, from individuals and business owners. The answer really lies understanding how to minimise your tax liabilities.

Spring Budget 2024 – Impact on the Agricultural Sector

The Spring budget did contain a few announcements which will impact the agricultural sector and consideration should be given to whether action is taken now.

Spring Budget Summary 2024

Following the 2024 Budget, three key announcements that will be important to any tax payers falling in the following groups:

Anyone who lets a holiday cottage

Property developers/investors and

Non UK Domiciled individuals

Multiple Dwellings Relief – Spring Budget Update 2024

This stamp duty land tax relief is to be abolished with effect for transactions with an effective date on or after 1 June 2024. Transitional rules mean that MDR can still be claimed for contracts which are exchanged on or before 6 March 2024, regardless of when completion takes place

Abolition of the Furnished Holiday Let rules – Spring Budget Update 2024

For anyone who owns one or more Furnished Holiday Lets (FHLs), either directly or through a limited company this is a significant change. Until April 2025, if an individual owned and let out a furnished holiday let, broadly a holiday home let out to different individuals for short periods, there were a number of tax advantages that in many respect treated this activity as a trade rather than as an investment:

Changes to Non Domicile Rules – Spring Budget Update 2024

The new rules that apply from April 2025 are proposed to operate for income tax purposes such that if a non UK domiciled individuals comes to live in the UK after a period of 10 years consecutive non-residence, there will be full tax relief for a 4-year period of subsequent UK tax residence on FIGs arising during this 4-year period, during which time this money will remain outside the UK tax net and can be brought to the UK without an additional tax charge.

Right shares, right time?

For start up businesses, it is important to think very carefully about who initial “founder” shares are issued to and consider future “what if” scenarios and how they might be dealt with.

Succcession – How planning ahead is the best option

The succession of the farm is often on the minds of those of whose farm has been in the family for many generations. Not only is it a wish that they would like the farm to continue within the family but also to provide an inheritance to any of their non farming children.

Holiday pay calculation simplified

The Government’s response to consultations on holiday pay for irregular hours workers has simplified the process. The new ruling effective from 1st April 2024, reinstates the 12.07% calculation method. This means that for every hour worked by staff, they accrue holiday leave and pay at a rate of 12.07%.

HMRC enforces tighter rules on side hustles

In a bid to tighten tax regulations and combat tax evasion, HMRC has introduced legislation that will impact sellers on platforms such as eBay, Vinted, Etsy Airbnb and Uber. As of 1 January 2024, many digital platforms are now mandated to collect and share transaction and seller details with HMRC

How Financial Modelling can improve business performance

Financial modelling can help businesses unlock information that can be the key to their strategic advantage.

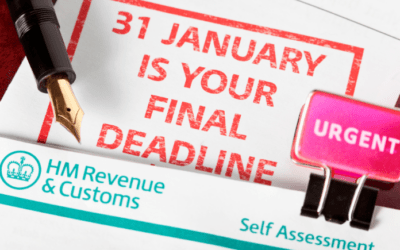

Are you one of the 12 million people that HMRC are expecting to file their tax return by the 31/01/2024?

Planning ahead is key and we advise clients against delaying the filing of returns until the last minute so that they can relax and enjoy the festive season.